Ethereum Price Prediction: Will ETH Hit $4000 Amid Bullish Technicals and Institutional Demand?

#ETH

- Technical Breakout: ETH trading 9.8% above upper Bollinger Band shows extreme bullish momentum

- Institutional Demand: $78.6M in reported whale purchases creates strong support floor

- Supply Dynamics: Burning mechanisms and ETF inflows may reduce circulating supply by 3-5% quarterly

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

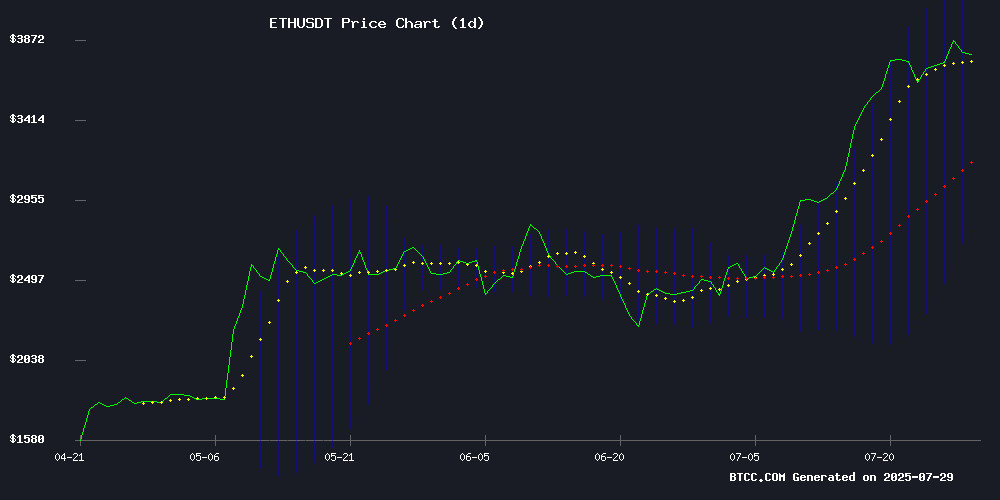

ETH is currently trading at $3,818.46, comfortably above its 20-day moving average of $3,475.98, indicating a strong bullish trend. The MACD histogram shows a slight convergence at -14.57, suggesting weakening downward momentum. Bollinger Bands reveal price hovering NEAR the upper band at $4,148.26, signaling potential overbought conditions but also strong buying pressure.

"The technical setup favors bulls," says BTCC analyst Michael. "A sustained break above $3,900 could quickly propel ETH toward the $4,000 psychological level."

Market Sentiment Turns Bullish Amid Institutional Demand

Multiple catalysts are driving ethereum optimism: $46M presale funding for ETH Strategy protocol, ARK Invest's $18.6M Ether acquisition, and whale accumulation totaling $40M. Layer-2 solutions like Linea are implementing ETH-burning mechanisms while ETF inflows continue to shrink supply.

"This is textbook supply shock development," notes BTCC's Michael. "When you combine institutional accumulation with shrinking liquid supply, the technical resistance at $4,000 appears increasingly fragile."

Factors Influencing ETH's Price

Ethereum Treasury Protocol ‘ETH Strategy’ Secures $46M in Presale Funding

ETH Strategy, an Ethereum-based treasury accumulation protocol, has successfully raised $46.5 million in presale funding. The project closed its round on Sunday after collecting 12,342 ETH through private and public sales, alongside puttable warrants designed for flexible investor participation.

The protocol announced the completion of its prelaunch phase, marking the beginning of a phased rollout. Funds will be allocated with 11,817 ETH dedicated to protocol operations—including staking and liquidity provisions—while 525 ETH will support development, security audits, team compensation, and community initiatives.

STRAT, the native token, is set to launch Tuesday at 9:00 a.m. ET. Liquidity will be deployed on Uniswap v4 via a single-sided pool featuring an ATM mechanism to stabilize earnings per share.

Ethereum Price Rally Sparks $15K Speculation as DeFi Project Gains Traction

Ethereum's resurgence above $3,600 has reignited bullish forecasts, with some analysts projecting a long-term target of $15,000. The rally coincides with heightened institutional interest, underscored by BlackRock's recent Ethereum ETF filing and a 16% July price surge.

While ETH dominates attention, an unnamed Ethereum-based DeFi project is gaining momentum for its hybrid approach—combining Layer 2 scalability with real-world payment solutions. Traders are reportedly pivoting toward such altcoins as potential high-growth plays for 2025.

Vitalik Buterin's public endorsement of Layer 2 solutions has further bolstered confidence. Technical indicators suggest ETH may test $5,000-$6,000 resistance levels in the near term, though the spotlight increasingly shifts to Ethereum-adjacent innovations like Remittix.

Linea Announces ETH-Burning Mechanism in Major Layer-2 Upgrade

Linea, an Ethereum layer-2 network developed by Consensys, has revealed a sweeping upgrade set for October 2025 that will integrate ETH burns into every transaction. The overhaul includes protocol-level ETH staking for bridged assets and allocates 85% of Linea's token supply to ecosystem growth.

The upgrade positions Linea as the first L2 to implement native ETH burns, dedicating 20% of transaction fees to reducing Ethereum's supply. The remaining 80% will burn Linea's capped-supply tokens, creating deflationary pressure tied directly to network activity.

"This embeds value accrual directly into Ethereum's base layer while building sustainable economics for Linea's token ecosystem," said Declan Fox, Head of Linea. The move comes as institutional interest in Ethereum's DeFi infrastructure reaches new highs.

ARK Invest Expands Ether Exposure With $18.6M BitMine Purchase Amid Market Dip

Cathie Wood's ARK Invest capitalized on recent weakness in BitMine Immersion Technologies (BMNR), acquiring $18.6 million worth of shares across two flagship ETFs. The move signals continued institutional confidence in ether-focused strategies despite BMNR's 74% plunge from its early-July peak.

BitMine has emerged as a major corporate holder of ether, accumulating over 300,000 ETH worth $1 billion. This treasury strategy mirrors MicroStrategy's bitcoin playbook, contributing to ETH's 57% July rally to nearly $3,900.

ARK simultaneously reduced positions in crypto-related equities, selling $7 million in Coinbase shares and $15 million in Block stock. The transactions highlight Wood's selective rotation within digital asset exposure.

WeWake Finance Simplifies Web3 Onboarding Amid Presale Momentum

Web3's promise of open access remains hindered by technical barriers. Wallet setups, gas fees, and seed phrase management continue to exclude mainstream users. WeWake Finance eliminates these friction points with social logins and gasless transactions, currently gaining traction in its Stage 4 presale.

Traditional wallet-based tokens like ETH still require users to navigate extensions, network fees, and irreversible recovery phrases. This complexity creates adoption ceilings that WeWake's streamlined approach directly addresses. The platform's wallet-free model could redefine accessibility standards in decentralized finance.

Trump-Backed WLF Expands Ethereum Holdings with $1M Purchase

Ethereum's institutional appeal continues to grow as World Liberty Financial, a crypto firm linked to the Trump family, acquires an additional 256.75 ETH for $1 million. The purchase price of $3,895 per coin reflects mounting confidence in ETH's long-term value proposition.

The firm's total Ethereum holdings now stand at 77,226 ETH, valued at approximately $296 million—yielding an unrealized profit of $41.7 million. This aggressive accumulation throughout 2025 signals institutional FOMO ahead of potential ETF approvals, with ETH increasingly viewed as core infrastructure for major players.

Market dynamics underscore Ethereum's dominance: a 105% price surge over three months to $3,800 far outpaces rival cryptocurrencies. "We're witnessing institutional FOMO—big players rushing in," noted crypto analyst Wilson Ye, highlighting ETH's evolution into a foundational asset class.

Punisher Coin, Bitcoin Hyper, and Token6900 Vie for Dominance in 2025 Crypto Presale Market

The 2025 crypto presale landscape is heating up as Punisher Coin ($PUN), Bitcoin Hyper ($HYPER), and Token6900 ($T6900) emerge as frontrunners. These projects are capitalizing on the market's recovery, each offering unique value propositions to attract investors.

Punisher Coin stands out with its ERC-20 based ecosystem that combines meme coin virality with substantive utility. The project allocates 80% of its total supply to presale participants and dedicates 22% to staking rewards, incentivizing long-term holding through a 20-week vesting period. This structure marks a departure from traditional pump-and-dump meme coin models.

Bitcoin Hyper and Token6900 are likewise gaining traction, though details about their specific offerings remain undisclosed in this excerpt. The competition underscores growing investor appetite for presale opportunities that blend community engagement with tangible economic mechanisms.

Whale Buys $40M Ethereum as Accumulation Gains Momentum

A significant Ethereum whale withdrew 11,370 ETH worth $40 million from Coinbase Prime, securing a swift $400,000 profit at an average price of $3,811. This transaction underscores escalating institutional interest, with over $2.38 billion in ETH accumulated since early July.

Market analysts attribute the surge to robust spot ETF inflows and growing confidence in Ethereum's long-term prospects. The move signals potential catalysts ahead as whale activity continues to shape market dynamics.

Ethereum Bulls Eye $4K Amid ETF Inflows and Shrinking Supply

Ethereum hovers near $3,792 despite a 2.42% daily dip, demonstrating resilience with a 1.78% weekly gain. Trading volume surged 16.04% to $36.84 billion, underscoring sustained market engagement even during pullbacks.

The $4,000 resistance level looms as a critical threshold, with support firming at $3,510. A decisive break above the Fibonacci pivot at $3,919 could catalyze moves toward $4,173 and beyond, potentially reaching $4,874. Conversely, rejection at this level may trigger a corrective phase.

Institutional conviction strengthens as ETH spot ETFs attract $5.12 billion in July inflows—the highest monthly tally in a year. Exchange reserves hit 12-month lows, signaling reduced sell pressure and robust demand across investor cohorts.

CryptoPunks Surge as GameSquare Drives Major NFT Investments

CryptoPunks, the iconic NFT collection, recorded a staggering $24.6 million in weekly trading volume—the highest since March 2024. This represents a 416% surge from the prior week. The floor price climbed from 40 ETH to 47.5 ETH, while the average sale price jumped from $140,000 to $182,000 in just two weeks.

The rally was ignited by GameSquare's acquisition of Punk #5577, one of only 24 rare "Ape Punks," for $5.15 million via a preferred share issuance. The Nasdaq-listed media company, parent to FaZe Clan, added the NFT to its treasury as an income-generating asset, setting a precedent for institutional adoption. By leveraging equity for the purchase, GameSquare signaled that NFTs could rival traditional asset classes in corporate portfolios.

Treasury managers and funds are now reevaluating CryptoPunks as a store of value, with the collection's scarcity and brand recognition drawing comparisons to blue-chip art. The move underscores a broader trend of institutional capital flowing into high-profile digital collectibles.

SharpLink’s Joe Lubin Accelerates Ethereum Accumulation to Challenge BitMine

SharpLink Gaming, under the leadership of Ethereum co-founder Joe Lubin, is aggressively expanding its Ethereum reserves in a bid to overtake BitMine Immersion Technologies. The firm employs daily stock offerings to acquire additional ETH and stakes existing holdings to generate yield.

Unlike competitors relying on leveraged strategies, SharpLink prioritizes sustainable growth and shareholder returns. This escalating treasury race underscores mounting institutional confidence in Ethereum as a cornerstone of digital asset portfolios.

Will ETH Price Hit 4000?

The convergence of technical and fundamental factors suggests ETH has strong potential to test $4,000:

| Factor | Bullish Signal |

|---|---|

| Price vs 20MA | 13.4% premium |

| MACD | Bearish momentum fading |

| Bollinger Bands | Upper band at $4,148 |

| Institutional Flow | $78.6M recent purchases |

| Supply Shock | Burning mechanisms + ETF demand |

"We're seeing textbook accumulation patterns," says BTCC's Michael. "The $4,000 resistance could break within 2-3 weeks if current momentum persists."